DSB announces inclusion of Alternative Underlier IDs to search for or create UPIs

Preparations continue ahead of UPI production launch on 16 October 2023

London, 15th August 2023 – The Derivatives Service Bureau (DSB), the global golden source of reference data for Over the Counter (OTC) derivatives, announces today that users of the Unique Product Identifier (UPI) User Acceptance Test (UAT) environment can now search and create UPIs using a range of Alternative Underlier IDs. This enhancement follows the implementation of the DSB’s reference data solution provided in partnership with The Association of National Numbering Agencies (ANNA) Service Bureau (ASB) and Intercontinental Exchange (ICE) as reference data providers, and with SmartStream as a reference data aggregator.

The Alternative Underlier ID feature allows firms to utilise data available in their existing workflow to obtain a UPI using different identifiers of the same underlier. The high-quality cross-referenced symbology data provided by ICE and SmartStream also helps enable the DSB to meet data quality objectives to ensure integrity, completeness, and consistency of the UPI codes and associated reference data.

Emma Kalliomaki, Managing Director, ANNA and DSB, said: “The introduction of the Alternative Underlier ID feature will provide fee-paying UPI users with the option to use the underlier ID of their choice, streamlining business processes and delivering efficiencies. This feature wouldn’t be possible without our chosen reference data partners whose data will also assist the DSB to monitor and assess UPI data quality which is fundamental to the success of the UPI System.”

Amanda Hindlian, President, Fixed Income and Data Services, ICE, said: “We are pleased to be part of the DSB’s reference data solution. Utilizing ICE’s comprehensive cross-reference capabilities will enable UPI users the ability to link to a various range of market standard identifiers.”

Linda Coffman, EVP Reference Data, SmartStream, said: “We are delighted to have been chosen by the DSB and working together, we will ensure the industry is equipped with the necessary tools to accommodate OTC reference data needs, and all upcoming regulatory requirements.”

Stephan Dreyer, MD of ANNA, said: “ANNA is proud of the global standards initiatives undertaken by the DSB. Use of the ANNA Service Bureau, as the golden source of ISIN data for financial and referential instruments, will facilitate delivery of the data quality requirements of the UPI Service given the use of ISIN as a primary identifier for the underlying instruments of OTC derivatives.”

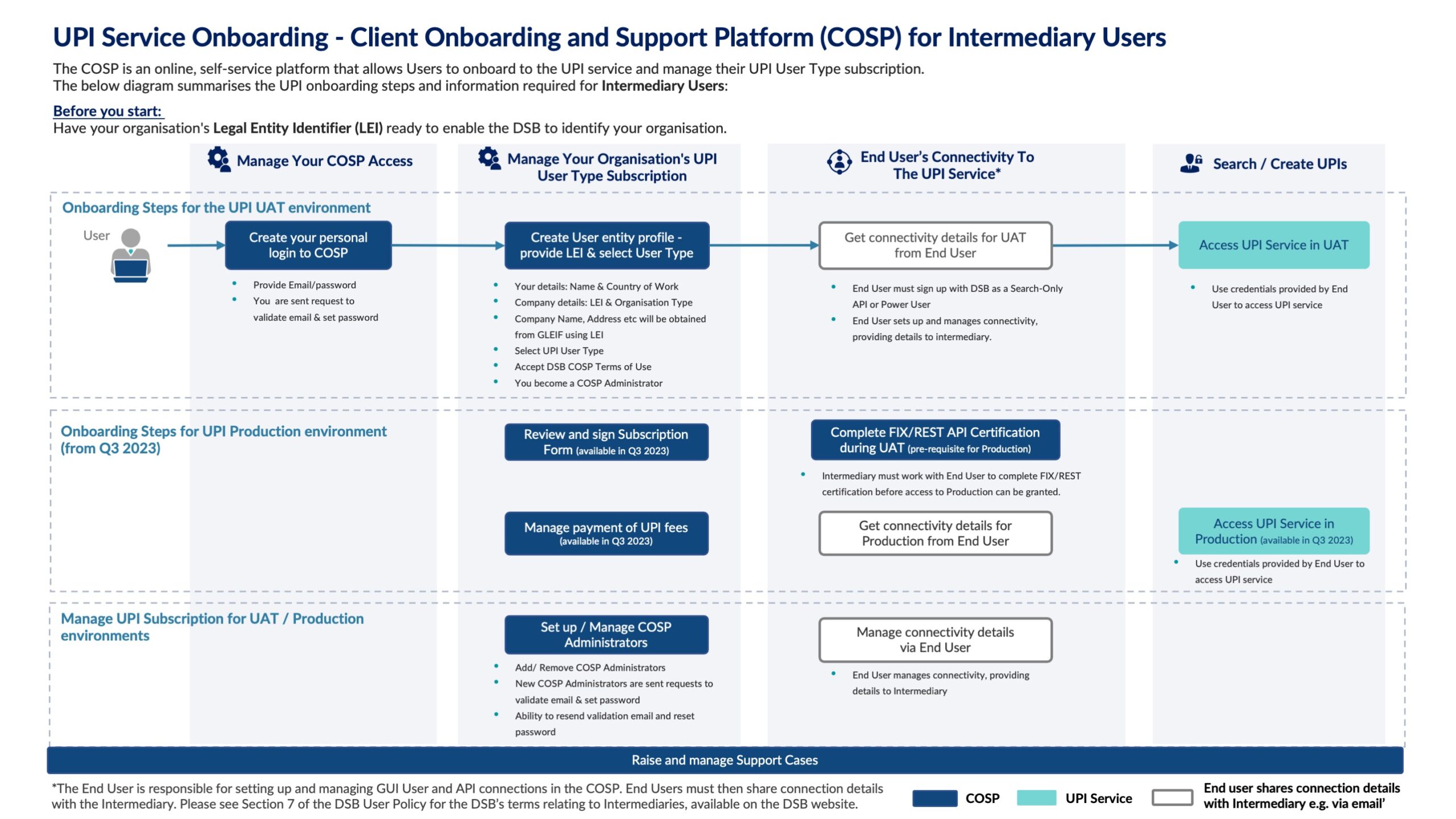

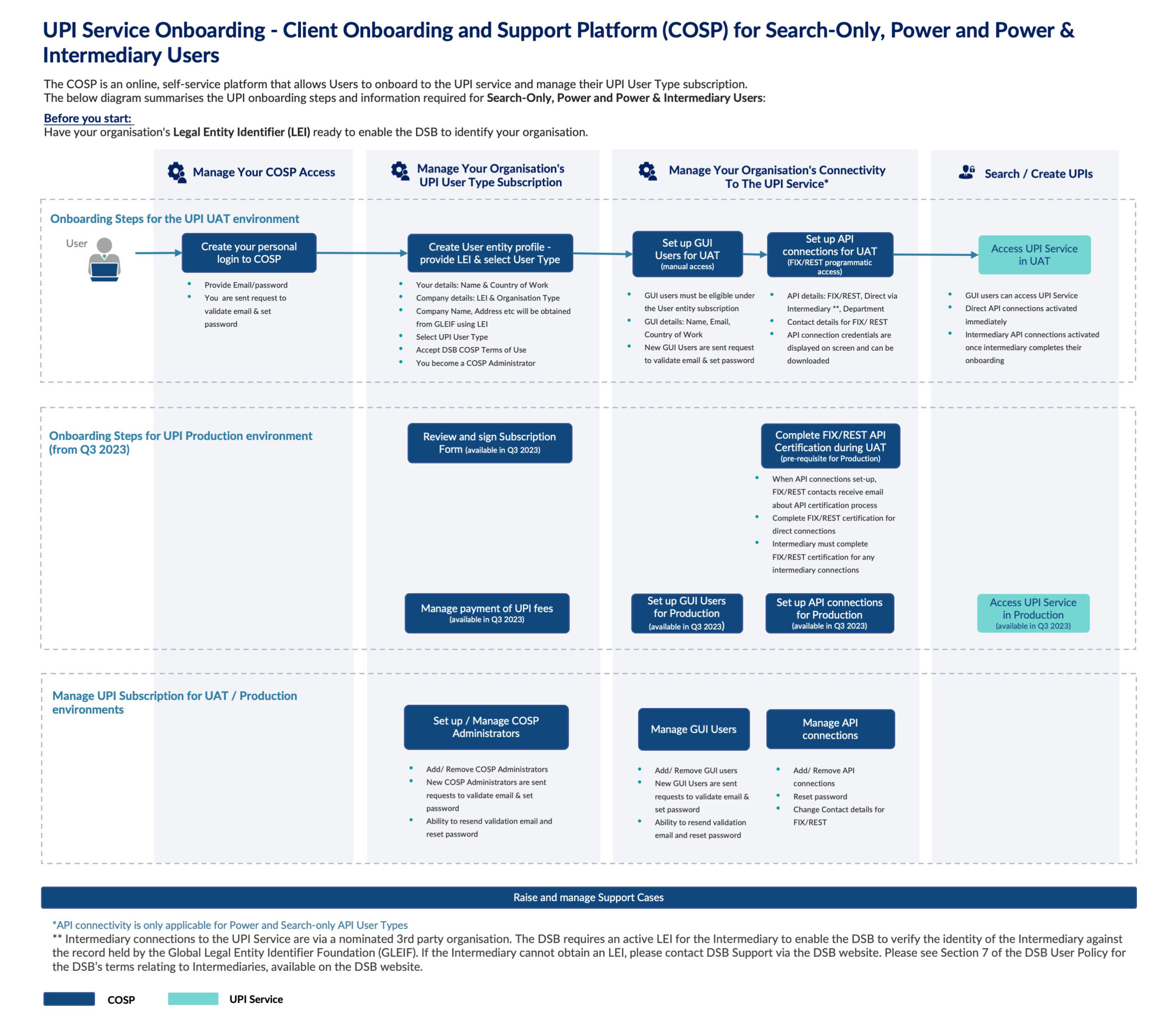

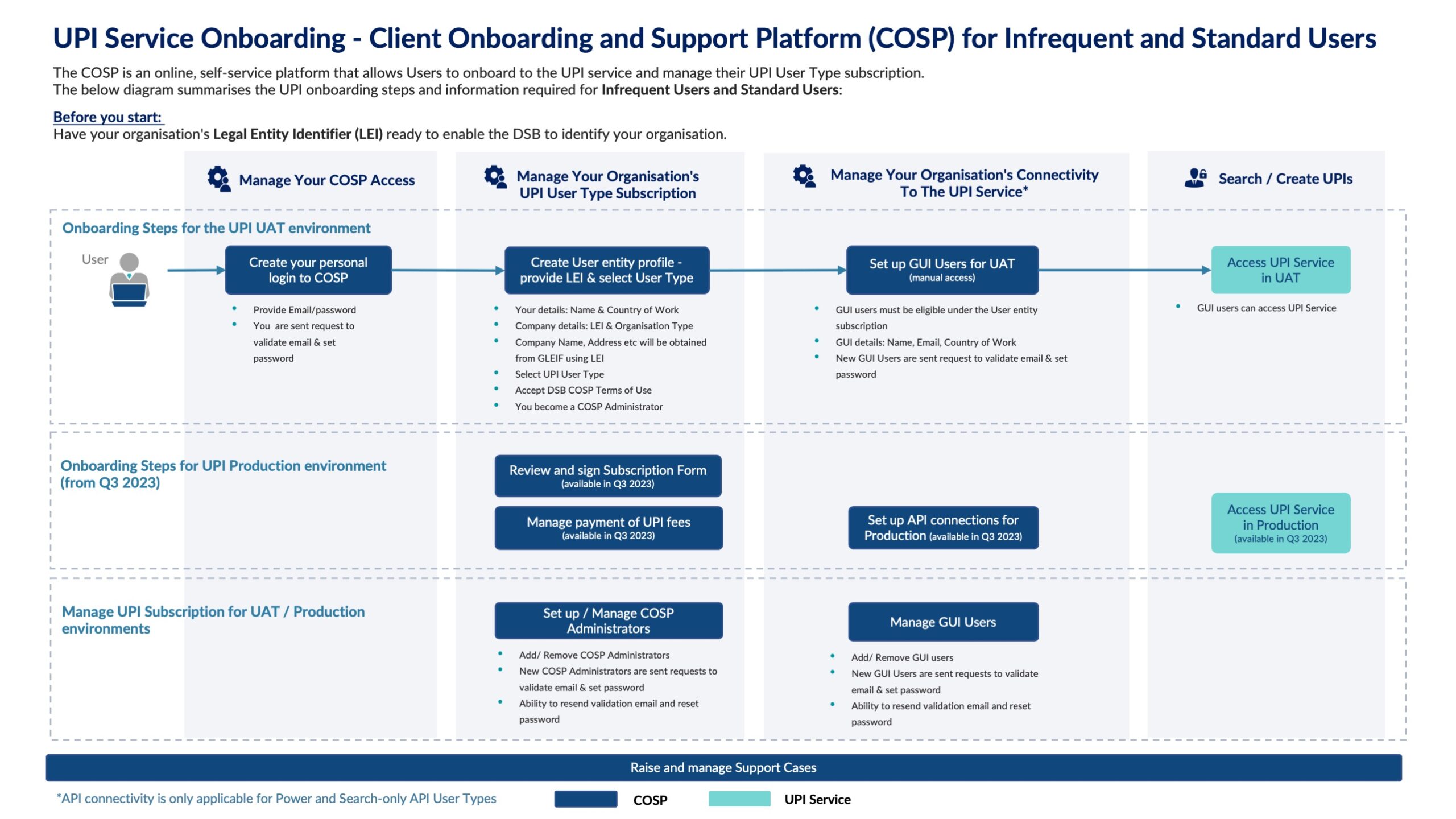

Subscribers to the UPI UAT Service are now able to request permission to use one or more Alternative Underlier IDs via the DSB’s Client Onboarding and Support Platform (COSP), based on the relevant Third-Party Data terms of the Third-Party Providers which license the identifiers.

ENDS

For further information:

Media contact for DSB and ANNA

Abby Munson

Streets Consulting

+44 (0)20 7073 2649

abby.munson@streetsconsulting.com

Media contact for SmartStream

Nathan Gee, Marketing Director, SmartStream

+44 (0) 20 7898 0630

nathan.gee@smartstream-stp.com

The Derivatives Service Bureau (DSB) Ltd

The Derivatives Service Bureau, DSB, is the global golden source of reference data for Over the Counter (OTC) derivatives. Serving over 4,000 users spanning approximately 500 institutions, the DSB enables market participants to meet their regulatory reporting obligations to trade repositories, and for post- trade transparency and market abuse reporting related to MiFID II. A global utility with widespread industry representation, expertise and collaboration at its core, the DSB provides its reference data on a cost-recovery basis to increase transparency, efficiencies and interoperability through the use of standards. Users can access the DSB’s automated zero-touch technology platform through an open and easily accessible web interface that can handle multiple taxonomies of definitions and descriptive data for near real-time allocation.

Founded by the Association of National Numbering Agencies, ANNA, the DSB is the sole source of multiple ISO standards for OTC derivatives, including International Securities Identification Numbers (ISINs), Unique Product Identifiers (UPIs), Classification of Financial Instruments Codes (CFIs) and Financial Instrument Short Names (FISNs). In addition to its ISO mandates, the DSB has been nominated by the Financial Stability Board of the G20 to be the exclusive global operator of the UPI Service. This service will enable authorities to aggregate data on OTC derivatives transactions by product or by any UPI reference data element. If you would like to use the Derivatives Service Bureau please visit the DSB website

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500 company that designs, builds and operates digital networks to connect people to opportunity. We provide financial technology and data services across major asset classes that offer our customers access to mission-critical workflow tools that increase transparency and operational efficiencies. We operate exchanges, including the New York Stock Exchange, and clearing houses that help people invest, raise capital and manage risk across multiple asset classes. Our comprehensive fixed income data services and execution capabilities provide information, analytics and platforms that help our customers capitalize on opportunities and operate more efficiently. At ICE Mortgage Technology, we are transforming and digitizing the U.S. residential mortgage process, from consumer engagement through loan registration. Together, we transform, streamline and automate industries to connect our customers to opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental Exchange, ICE, ICE block design, NYSE and New York Stock Exchange. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is located here. Key Information Documents for certain products covered by the EU Packaged Retail and Insurance-based Investment Products Regulation can be accessed on the relevant exchange website under the heading “Key Information Documents (KIDS).”=

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 — Statements in this press release regarding ICE’s business that are not historical facts are “forward-looking statements” that involve risks and uncertainties. For a discussion of additional risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see ICE’s Securities and Exchange Commission (SEC) filings, including, but not limited to, the risk factors in ICE’s Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on February 2, 2023.

About SmartStream

SmartStream is a recognised leader in financial transaction management solutions that enable firms to improve operational control, reduce costs, build new revenue streams, mitigate risk and comply accurately with the regulators.

By helping its customers through their transformative digital strategies, SmartStream provides a range of solutions for the transaction lifecycle with AI and machine learning technologies embedded – which can be deployed in the cloud or as managed services.

As a result, more than 2,000 clients – including the world’s top 100 banks, rely on SmartStream Transaction Lifecycle Management (TLM®) solutions to deliver greater efficiency to their operations. www.smartstream-stp.com

About ANNA

The Association of National Numbering Agencies (ANNA) is a global member association seeking to foster standardisation within the financial industry by upholding the International Organization for Standardization (ISO) principles and by promoting ISIN, FISN and CFI codes for financial instruments. This is achieved through ongoing, collaborative work with market participants, regulators and other standards bodies.

Under ANNA’s stewardship, the role of the ISIN in enabling global financial communications has been established worldwide. Founded in 1992 by 22 numbering agencies, today ANNA’s membership continues to grow, with more than 120 global members and partners allocating ISIN, FISN and CFI codes on behalf of their local jurisdictions. By putting in place rigorous governance around the development, allocation and sharing of ISIN, FISN and CFI codes, ANNA helps facilitate open, transparent markets diminishing barriers to access, while protecting the integrity of the standards. As a result, ISIN has become the recognised global standard for unique identification for all types of financial and referential instruments, helping to connect and protect global markets.

In addition, ANNA has established the Derivatives Service Bureau (DSB), a fully automated global numbering agency to meet the specific operational and regulatory requirements of the over-the-counter derivatives markets.

For information about ANNA, its members and activities, please visit anna-web.org.