First published on Thomson Reuters Regulatory Intelligence on 23rd February 2024.

As UPI regulatory reporting goes live in U.S., there are opportunities for European OTC derivative markets

By Emma Kalliomaki, Managing Director, ANNA and the DSB

In 2014, in the aftermath of the 2008 financial crisis, the Financial Stability Board (FSB) proposed a globally harmonised Unique Product Identifier (UPI). Its purpose was to assist regulators in identifying the build-up of systemic risk in over-the-counter (OTC) derivatives.

Ten years later, and following a huge international effort from regulators, standards bodies, industry and the Derivatives Service Bureau (DSB), which issues the UPI, 2024 will see the realization of the G20’s UPI commitment.

On January 29, the United States became the first G20 jurisdiction to implement mandatory Unique Product Identifier reporting. Many firms are now gearing up for the second milestone on April 29, when UPI reporting starts in the European Union.

Below are insights from the DSB on the U.S. launch, as well as a look ahead to the start of EU reporting and the much-discussed question of scope.

U.S. UPI reporting now live

Since the Derivatives Service Bureau launched the UPI Service User Acceptance Testing (UAT) environment in April 2023, followed by the UPI Service production environment on October 16, 2023, industry preparation has gathered momentum.

With U.S. regulatory authorities playing a long-term and active role in the development of the UPI and its reporting requirements, the DSB hosted a virtual Q&A with the Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC) to answer industry questions on January 17. At this point, data showed that users were taking the necessary actions to meet compliance obligations.

A total of 131 organisations have fee-paying subscriptions, and 35% of onboarded organisations have headquarters in the United States. By the end of January, this figure had reached 40%, making the United States the jurisdiction represented by the most entities.

The number of UPIs created is another figure of perennial interest to DSB stakeholders. By the end of January 2024, users had created 225,000 UPIs, in addition to the approximately 700,000 UPIs created by the DSB using its own database. This has resulted in a cache of almost 1 million UPIs at the start of U.S. reporting.

With the DSB UAT environment enabling firms to test workflows, data integration options and downstream processes in advance of compliance dates, DSB data shows that users spend an average of two months in testing before shifting into production.

EU is next

On April 29, 2024, the EU EMIR Refit Regulations will come into effect, introducing a specific scope for UPI reporting alongside the existing use of ISIN for OTC derivative reporting. The ISIN, like the UPI, is an International Organisation for Standardisation (ISO) identifier issued by the DSB.

Questions about whether to report the ISIN or the UPI, and why the EU chose both identifiers, come up regularly. There is a definite rationale for the EU’s approach: cross-regulation consistency and lower reporting burdens for firms.

Today, the EU and UK use the ISIN in three sets of reporting rules: THE Markets in Financial Instruments Regulation (MiFIR) for both price transparency and market abuse detection purposes and under the EMIR to aggregate OTC derivatives data. European regulators decided to use the ISIN for EU regulatory reporting under MiFIR back in 2015, but knowing the UPI was on the horizon, the DSB worked with market participants, the ISO and EU/UK regulators to ensure the ISIN design was consistent and complementary with the UPI.

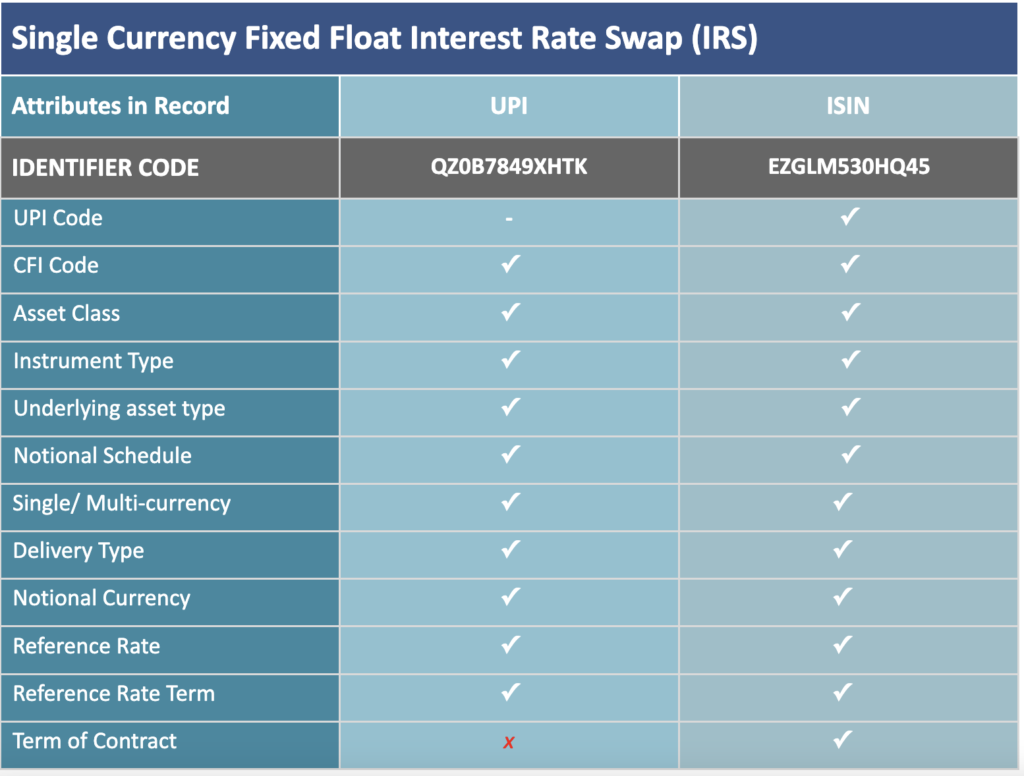

That means UPI data attributes and the UPI code itself are included in the ISIN record. If you have the ISIN, you have the UPI, ensuring global convergence and harmonisation.

The below table illustrates the complementary nature of the UPI and the ISIN. For each OTC derivative, the ISIN and UPI share the same attributes, with the ISIN having a couple of additional attributes as a more granular identifier.

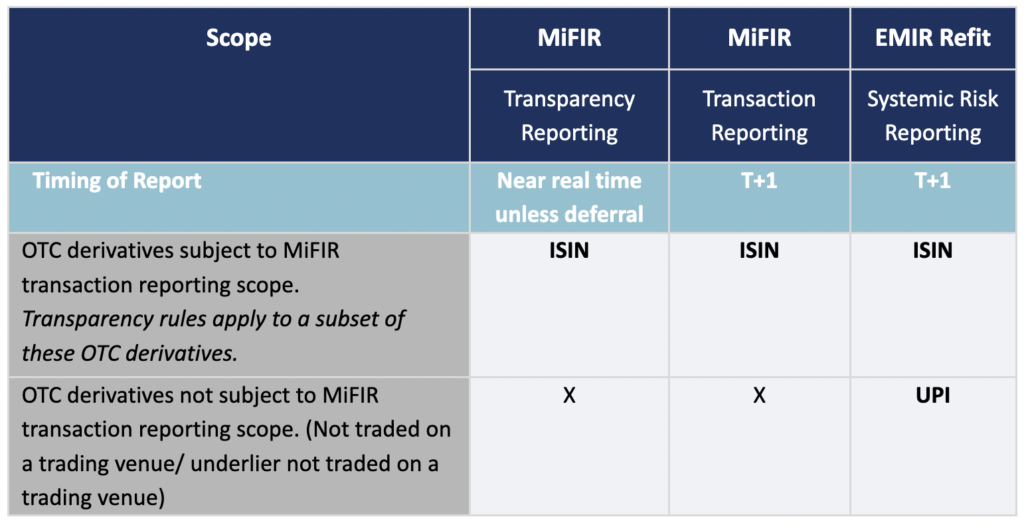

The scope of OTC derivatives reporting under EMIR is wider than MiFIR. There is a group of OTC derivatives where neither they nor the underlier are traded on a trading venue, for which the ISIN is not required under MiFIR. Today, under EMIR, the Classification of Financial Instruments (CFI) code is used for this set of OTC derivatives. From April 2024, the UPI code will be used.

The table below provides a high-level summary of which identifier will be used in the EU for which OTC derivatives reporting requirement from April 2024.

The EU has leveraged the ISIN to limit firms’ changes to “pure” OTC derivatives where the UPI will be reported instead of the Classification of Financial Instruments code.

The ISIN for OTC derivatives provides an early example of a recommendation made by CPMI-IOSCO, the body asked by the FSB to develop global guidance on the UPI. “The UPI could be leveraged to define other more granular derivatives identifiers for other purposes,” CPMI-IOSCO said in its UPI Technical Guidance.

While the UPI was designed to help identify the build-up of systemic risk at a global level, some jurisdictions are exploring broader use cases for OTC derivative identifiers. There are likely to be further developments on this front as regulators leverage the benefits of global harmonisation and alignment.

From Europe to APAC

Other major jurisdictions also go UPI-live in 2024 and 2025, including the UK on September 30, 2024, Australia and Singapore from October 21, 2024, and Japan on April 7, 2025.

With firms needing to consider their integration, reporting workflows and downstream dependencies for implementation, the DSB encourages stakeholders to onboard in good time before their first reporting deadlines.

Information on the DSB’s Client Onboarding Support Platform, best practice guidance and a dedicated online support function that is available 24 hours, 6.5 days a week, can be found on the DSB website here.